Wall Street Meets Mumbai: Simplifying Jane Street’s $600 Million India Market Ban

TL;DR

Jane Street, a major American trading firm, has been barred from Indian markets by SEBI and had nearly ₹4,800 crores seized. The reason? SEBI says Jane Street manipulated the BANK NIFTY index using high-speed trading strategies, trapping retail traders and reaping massive profits. Here’s what happened, how, and why it matters for anyone trading derivatives in India.

What Is the Jane Street Saga and Why Is SEBI Involved?

Jane Street is a global trading powerhouse known for its sophisticated algorithms and lightning-fast trades. In early 2025, India’s market regulator SEBI (Securities and Exchange Board of India) barred Jane Street and seized ₹4,800 crores in alleged illegal profits. The charge: market manipulation in the Indian derivatives market, specifically BANK NIFTY options.

Why Did SEBI Target Jane Street?

- Unusual Trading Patterns: SEBI noticed Jane Street was making outsized profits, especially on expiry days for BANK NIFTY options.

- Media and Lawsuit Trigger: The investigation began after media reports on a lawsuit between Jane Street and Millennium Management revealed the existence of a secret, highly profitable trading algorithm.

- Regulatory Mandate: SEBI’s job is to ensure fair play in Indian markets and protect retail investors from manipulation.

How Did Jane Street Allegedly Manipulate the Market?

Understanding the Playground: Cash vs. Derivatives

- Cash Market: Where you buy/sell actual shares.

- Derivatives Market: Where you trade contracts (futures and options) based on share prices, without owning the shares.

The Mechanics of the Alleged Manipulation

Jane Street’s strategy centered on the BANK NIFTY index, which tracks India’s largest banks. Here’s a simplified version of what SEBI says happened:

This method will instantly start hair growth

this method will instantly start hair growth...

Do this twice a day, and everyone will think you have Botox!

do this twice a day, and everyone will think you have botox!...

Varicose Veins Disappear As if They Never Happened! Use It Before Bed

varicose veins disappear as if they never happened! use it before bed...

I did this and my knees and joints haven’t hurt for 10 years now.

i did this and my knees and joints haven’t hurt for 10 years now....

- Pump: Jane Street bought large amounts of BANK NIFTY stocks, pushing up their prices and, by extension, the BANK NIFTY index.

- Retail Rush: Retail traders saw the index rising and bought call options, betting on further gains.

- Trap: Jane Street, meanwhile, sold call options to these traders and bought put options (bets that the index would fall).

- Dump: Once enough retail traders were “trapped,” Jane Street sold off its BANK NIFTY holdings, causing the index to drop.

- Profit: The puts soared in value, the calls expired worthless, and Jane Street pocketed both the put profits and call premiums.

Two Key Tactics Identified by SEBI

- Intra-day Index Manipulation: Buying large volumes of BANK NIFTY stocks and futures in the morning, even on weak market days, to artificially boost the index.

- Extended Marking the Close: Aggressively selling BANK NIFTY stocks and futures just before market close to drag down the index and lock in profits from put options.

Why Did Jane Street Focus on BANK NIFTY Options?

- Liquidity Magnet: BANK NIFTY options are among the most heavily traded derivatives in India, with millions of contracts changing hands daily.

- Retail Participation: The sheer number of retail traders in BANK NIFTY options made it easier for Jane Street to find buyers for its calls and sellers for its puts.

- Low Cost, High Leverage: Options allow traders to take big positions with small upfront payments (premiums), making them attractive but risky.

-

What Evidence Did SEBI Find Against Jane Street?

- Profit Patterns: SEBI tracked Jane Street’s trades from January 2023 to March 2025, identifying 18 days with suspiciously high profits—mostly on options expiry days.

- Algorithmic Trading: The trades were executed at speeds and volumes only possible with advanced algorithms, not manual trading.

- Market Impact: On several occasions, Jane Street’s trades moved the BANK NIFTY index sharply, influencing settlement prices and options values.

SEBI’s Interim Order

- Market Ban: Jane Street and its affiliates are barred from Indian markets pending further investigation.

- Asset Seizure: Nearly ₹4,800 crores—profits SEBI claims were made illegally—have been frozen.

- Ongoing Legal Battle: Jane Street disputes the charges and can appeal to the Securities Appellate Tribunal.

Why Does This Matter for Retail Traders and the Indian Market?

Lessons for Retail Investors

- F&O Is Not a Level Playing Field: Most retail traders lose money in options; sophisticated players with advanced tools have a massive edge.

- Market Manipulation Can Happen: Even in regulated markets, big players can move prices—sometimes at the expense of smaller investors.

- Know the Risks: Understanding who you’re trading against is as important as knowing what you’re trading.

Impact on Indian Markets

- Liquidity Concerns: Some worry that SEBI’s crackdown will scare away institutional traders, reducing liquidity in F&O markets.

- Regulatory Upgrades: The saga highlights the need for better surveillance, faster detection of manipulation, and tighter rules.

What Happens Next?

- Appeals and Investigations: Jane Street is expected to challenge SEBI’s order. SEBI may expand its probe to other firms and indexes.

- Possible Reforms: The case could lead to stricter rules on algorithmic trading and more robust protections for retail traders.

Frequently Asked Questions

Was all of Jane Street’s profit illegal?

No. SEBI’s order targets profits it believes were made through manipulation, not all trading gains.

Can Jane Street return to Indian markets?

Not until the investigation concludes and the Securities Appellate Tribunal rules on its appeal.

What should retail traders do?

Stay informed, understand the risks of F&O trading, and be wary of following market moves driven by big players.

This article Wall Street Meets Mumbai: Simplifying Jane Street’s $600 Million India Market Ban appeared first on BreezyScroll.

Read more on BreezyScroll.

Humans May Owe Their Love of Alcohol to Primate Ancestors

Why do humans across cultures keep coming back to alcohol, despite knowing its risks? From wine at weddings to beer after work, drinking is woven into social life in ways few other substances are. According...

December 25, 2025

11:11 am

If You Find Moles or Skin Tags on Your Body, Read About This Remedy. Genius!

if you find moles or skin tags on your body, read about this remedy. genius!...

December 25, 2025

11:02 am

End of Duopoly? India Clears Al Hind and FlyExpress After IndiGo Disruptions

India’s tightly concentrated airline market may be on the verge of its most significant shake-up in years. Weeks after widespread flight cancellations by IndiGo left thousands of passengers stranded, the Indian government has granted initial...

December 25, 2025

11:06 am

This is a sign! Money is in sight! Read this and get rich.

this is a sign! money is in sight! read this and get rich....

December 25, 2025

10:57 am

When Warning Became A Crime: China’s Covid Whistleblowers, Six Years later

As 2025 draws to a close, December 31 marks six years since China first notified the World Health Organization about a mysterious pneumonia spreading in Wuhan. That date has become a fixed point in global...

December 24, 2025

12:43 pm

Doctor: A Teaspoon Kills All Parasites In Your Body!

doctor: a teaspoon kills all parasites in your body!...

December 24, 2025

12:24 pm

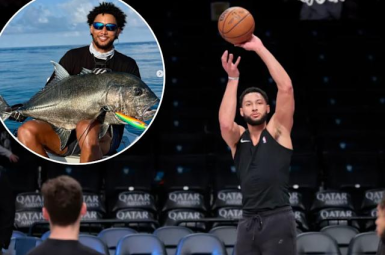

Ben Simmons Puts NBA Comeback on Hold to Chase Pro Fishing Career

Ben Simmons isn’t chasing a comeback headline the usual way. The former No. 1 overall pick, once positioned as a franchise cornerstone for the Philadelphia 76ers and later a high-profile gamble for the Brooklyn Nets,...

December 24, 2025

12:15 pm

Do This Every Night and the Fungus Will Disappear in 5 Days

do this every night and the fungus will disappear in 5 days...

December 24, 2025

12:11 pm

What Does ‘Nubile’ Mean? Fake Epstein Letter Referencing Trump Sparks Buzz

A newly resurfaced document tied to convicted sex offender Jeffrey Epstein has ignited renewed scrutiny, not just for its disturbing content, but for growing questions over whether it is real at all. The handwritten letter,...

December 24, 2025

12:06 pm

A spoon on an empty stomach burns 26 lbs in a week

a spoon on an empty stomach burns 26 lbs in a week...

December 24, 2025

11:40 am

Money Match Checks: Pennsylvania Sends Over $22 Million to 100,000 Residents. Who Gets What?

Nearly 100,000 residents across Pennsylvania have received an unexpected envelope in the mail this year, and for once, it is not a scam. The state has confirmed that it has mailed checks worth more than...

December 24, 2025

11:56 am

This method will instantly start hair growth

this method will instantly start hair growth...

December 24, 2025

11:42 am