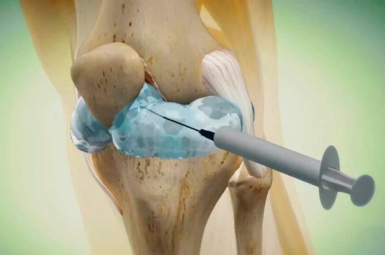

the secret way to get rid of knee and joint pain!...

August 8, 2025

4:58 pm

seer teresa: if you carry them in your pocket, you will have a lot of money...

August 8, 2025

5:21 pm

Trump Administration Eyes IPOs of Fannie Mae and Freddie Mac in 2025

August 8, 2025

17:25

President Donald Trump is reportedly pushing for the long-delayed IPOs of mortgage finance giants Fannie Mae and Freddie Mac by the end of 2025. The move could raise up to $30 billion and mark a major shift in the U.S. housing finance system, with the two firms having been under federal conservatorship since the 2008 financial crisis. While supporters believe privatization would boost efficiency and attract investment, challenges remain due to the scale of government involvement and systemic risk.

Fannie Mae (FNMA) and Freddie Mac (FMCC) are the twin pillars of America’s secondary mortgage market. Established by Congress, their mandate is to keep homeownership affordable by injecting liquidity into the housing market.

Here’s how they work:

Recent Posts

if you find moles or skin tags on your body, read about this remedy. genius!...

August 8, 2025

4:55 pm

this method will instantly start hair growth...

August 8, 2025

5:02 pm

lose 40 lbs by consuming before bed for a week...

August 8, 2025

5:21 pm

worms come out of you in the morning. try it...

August 8, 2025

5:01 pm

This cycle allows lenders to issue more loans, effectively recycling capital and keeping mortgage financing widely available and relatively low-cost.

These government-sponsored enterprises (GSEs) currently guarantee over $7 trillion in mortgage debt, making them critical to housing stability in the U.S.

During the 2008 global financial crisis, both companies suffered massive losses due to exposure to risky subprime mortgages. The government stepped in with a bailout:

Recent Posts

the fungus will disappear in 1 day! write a specialist's prescription...

August 8, 2025

5:18 pm

a young face overnight. you have to try this!...

August 8, 2025

5:12 pm

varicose veins disappear as if they never happened! use it before bed...

August 8, 2025

5:08 pm

i did this and my knees and joints haven’t hurt for 10 years now....

August 8, 2025

5:10 pm

Despite years of profitability, Fannie and Freddie have remained in “conservatorship” under the Federal Housing Finance Agency (FHFA), effectively under government control. Efforts to privatize them—including during Trump’s first term—have stalled due to political, regulatory, and market complications.

According to the Wall Street Journal, President Trump’s team is actively preparing to launch IPOs for both Fannie Mae and Freddie Mac before the end of 2025. Key details from the report include:

This move would represent one of the largest privatizations in U.S. history and a defining moment for the Trump administration’s financial policy in its second term.

Recent Posts

after reading this, you will be rich in 7 days...

August 8, 2025

5:23 pm

read this immediately if you have moles or skin tags, it's genius...

August 8, 2025

4:59 pm

this method will instantly start hair growth...

August 8, 2025

5:16 pm

lose 40 lbs by consuming before bed for a week...

August 8, 2025

5:01 pm

With Trump back in office and reshaping economic policy around deregulation and market-driven reforms, reviving GSE privatization aligns with his broader agenda.

Fannie and Freddie shares (traded over-the-counter) surged over 20% following the news, signaling investor enthusiasm. Billionaire investor Bill Ackman, who has long held stakes in the companies, had earlier said he was counting on Trump to “finish the job.”

While mortgage rates remain volatile, demand for housing continues to rise, and stakeholders argue that a private, well-capitalized Fannie and Freddie could increase efficiency and innovation in mortgage services.

Recent Posts

this simple trick removes all parasites from your body!...

August 8, 2025

5:10 pm

do this every night and the fungus will disappear in 5 days...

August 8, 2025

5:05 pm

a young face overnight. you have to try this!...

August 8, 2025

5:08 pm

america is in shock! it helps to get rid of varicose veins. do it at night...

August 8, 2025

5:09 pm

Privatizing firms that back over half of America’s mortgage debt carries serious risks. Any instability in these companies post-IPO could ripple through the entire financial system.

Democratic lawmakers and some housing advocacy groups warn that privatization could reduce oversight, raise costs for low-income borrowers, or even lead to discrimination in loan access.

Extracting the federal government from Fannie and Freddie isn’t simple:

Recent Posts

forget about joint pain forever – the solution is here!...

August 8, 2025

5:16 pm

this is a sign! money is in sight! read this and get rich....

August 8, 2025

5:09 pm

if you find moles or skin tags on your body, read about this remedy...

August 8, 2025

5:14 pm

salvation from baldness has been found! (do this before bed)...

August 8, 2025

4:55 pm

Even Trump has stated that the federal government would likely retain some role. That might create ambiguity for investors—are they truly private, or hybrid entities?

If the Trump administration proceeds, here are the likely next steps:

The Fannie Mae and Freddie Mac IPO plan could represent a landmark economic shift, unlocking billions in capital and reshaping how America funds homeownership.

But it’s also a calculated risk: balancing private sector efficiency with public good, all while managing trillions in mortgage exposure. With Trump’s second-term economic agenda in full swing, eyes will be on how this unfolds—and whether the IPOs deliver long-promised reform or rekindle old vulnerabilities.

Recent Posts

Why do humans across cultures keep coming back to alcohol, despite knowing its risks? From wine at weddings to beer after work, drinking is woven into social life in ways few other substances are. According...

December 25, 2025

11:11 am

lose 40 lbs by consuming before bed for a week...

December 25, 2025

11:09 am

India’s tightly concentrated airline market may be on the verge of its most significant shake-up in years. Weeks after widespread flight cancellations by IndiGo left thousands of passengers stranded, the Indian government has granted initial...

December 25, 2025

11:06 am

4 signs telling that parasites are living inside your body...

December 25, 2025

10:55 am

As 2025 draws to a close, December 31 marks six years since China first notified the World Health Organization about a mysterious pneumonia spreading in Wuhan. That date has become a fixed point in global...

December 24, 2025

12:43 pm

do this every night and the fungus will disappear in 5 days...

December 24, 2025

12:13 pm

Ben Simmons isn’t chasing a comeback headline the usual way. The former No. 1 overall pick, once positioned as a franchise cornerstone for the Philadelphia 76ers and later a high-profile gamble for the Brooklyn Nets,...

December 24, 2025

12:15 pm

55-year-old woman with baby face. here's her secret!...

December 24, 2025

11:54 am

A newly resurfaced document tied to convicted sex offender Jeffrey Epstein has ignited renewed scrutiny, not just for its disturbing content, but for growing questions over whether it is real at all. The handwritten letter,...

December 24, 2025

12:06 pm

varicose veins disappear as if they never happened! use it before bed...

December 24, 2025

11:54 am

Nearly 100,000 residents across Pennsylvania have received an unexpected envelope in the mail this year, and for once, it is not a scam. The state has confirmed that it has mailed checks worth more than...

December 24, 2025

11:56 am

people from us those with knee and hip pain should read this!...

December 24, 2025

11:44 am