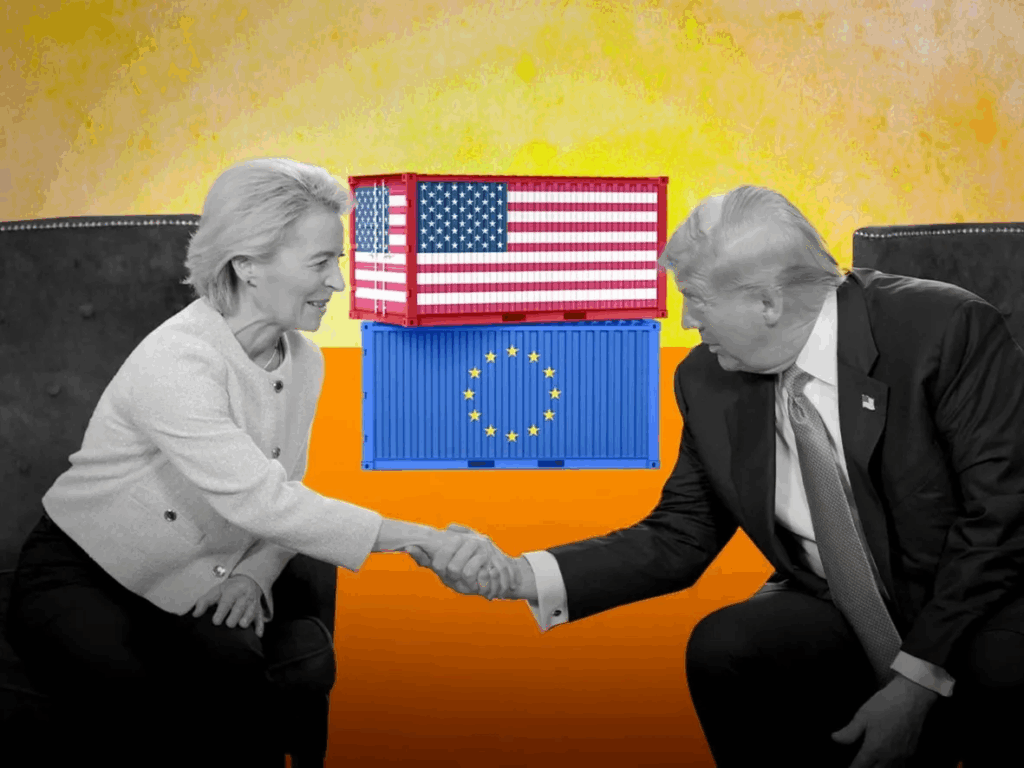

How the New US–EU Trade Deal Hits Your Wallet and What You’re Likely to Pay More (or Less) For

Quick Summary

A US–EU trade deal announced July 27, 2025, sets a 15% tariff on most European goods entering America, lower than Trump’s threatened 30% but much higher than historic levels. Some “strategic” goods get zero tariffs. For everyday consumers, expect price hikes on imports like wine, cars, and electronics, while U.S. energy prices may ease. Critically, the deal remains incomplete, with pharmaceuticals, steel, and agriculture still in flux.

What’s in the US–EU trade deal, and why was it needed?

- The U.S. will impose a 15% tariff on most European imports, down from the threatened 30% or even 50% rate. That includes autos, chips, wine, and more.

- In return, the EU pledges to buy $750 billion in U.S. energy and invest $600 billion in U.S. industries.

- Certain “strategic” sectors—aircraft parts, chemicals, semiconductor gear, and some agricultural commodities- benefit from zero-for-zero tariff treatment

What does this mean for everyday consumers?

Which prices will go up?

- European imports: A default 15% surcharge likely gets passed to consumers in items like wine, cheese, luxury goods, and EU-made electronics.

- European-made autos: existing duties (including 2.5% base plus Trump’s prior 25% car tariff) roll into the blanket 15%, pushing sticker prices up, especially for brands like Mercedes or VW imported from Europe.

Which prices may go down or stabilize?

- U.S.-made energy: increased EU demand may ease domestic gas and oil prices—but analysts call the $250B/year volume unrealistic, so the impact may be muted.

- Some industrial supplies: tariff-free access on aircraft parts, critical chemicals, and select agricultural products may help temper costs in certain sectors.

Who stands to win or lose?

Winners:

- U.S. energy producers get potential export boost from Europe’s commitments—but feasibility is questioned by experts.

- Strategic U.S. exporters in chemicals, aerospace, and semiconductor equipment may expand access thanks to zero tariffs.

- Investors welcomed clarity: markets rallied after the deal averted a broader trade war.

Losers:

- Reluctant European exporters, especially in autos, wine, and pharmaceuticals, now face costs that undermine their U.S. competitiveness.

- American consumers buying European goods risk price increases across several product categories.

- Steel and aluminum users: The 50% U.S. tariff on these remains untouched, leaving input-heavy industries exposed.

How will common families feel it?

- Wine and spirits lovers: costs from European bottles may rise due to tariffs.

- Auto buyers: European-brand cars from abroad become more expensive; domestically made U.S. options may comparatively feel cheaper.

- Tech gadget shoppers: imported semiconductors or associated devices still face the 15% levy unless exempted, raising retail prices.

- Energy bills: might trend downward if exports and production dynamics shift, but uncertainty around volume makes that effect modest.

- Manufactured goods: Some U.S.-made tools or aerospace gear may stay stable thanks to tariff-free rules; others may face secondary cost ripple effects.

Why does this deal matter, and what’s still missing?

Big-picture stakes

- The deal halts an impending tariff escalation, shielding at least a portion of U.S.–EU trade from chaotic disruptions.

- But the asymmetric structure, with U.S. tariffs imposed widely and European exemptions more limited, has drawn criticism from EU leaders who feel badly squeezed.

What remains unresolved:

- Steel and aluminum tariffs remain at 50%—still not part of the new framework.

- Pharmaceuticals and farm produce: negotiating status and clarity is still pending.

- Precise investment commitments: timelines or specific sectors for the $600B EU investment are unspecified, raising questions about enforcement and realism.

In a nutshell

This U.S.–EU trade deal offers short-term stability—but with a price tag. Consumers may see costlier wine, cars, and electronics, while ground-level benefits like cheaper energy or exempt industrial goods remain tentative. Until unresolved sectors like pharmaceuticals and farm imports get finalized, both consumers and businesses should brace for uneven impact across different goods.

This article How the New US–EU Trade Deal Hits Your Wallet and What You’re Likely to Pay More (or Less) For appeared first on BreezyScroll.

Read more on BreezyScroll.

Nancy Guthrie Kidnapping: Savannah Guthrie Announces $1M Reward In Search For Missing Mother

The Nancy Guthrie kidnapping case has entered a critical phase, with television anchor Savannah Guthrie announcing a $1 million reward for information leading to her 84-year-old mother’s return. Nearly a month after Nancy Guthrie vanished...

February 25, 2026

4:13 am

America is in Shock! It Helps to Get Rid of Varicose Veins. Do It at Night

america is in shock! it helps to get rid of varicose veins. do it at night...

February 25, 2026

4:07 am

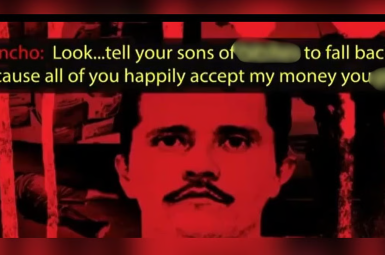

‘Fall Back’: Leaked Audio Shows El Mencho Threatening Cops

Within hours of the death of Nemesio “El Mencho” Oseguera Cervantes, leader of the Jalisco New Generation Cartel, Mexico was once again confronting a familiar question: how deep did the cartel’s influence run? Now, a...

February 24, 2026

1:09 pm

The Fungus Will Disappear In 1 Day! Write Down An Expert's Recipe

the fungus will disappear in 1 day! write down an expert's recipe...

February 24, 2026

1:01 pm

Flights Halted, Army Deployed: Mexico on Edge After El Mencho’s Killing

Flights disrupted, army on the road, and rising fears of turf wars define Mexico 24 hours after El Mencho’s killing. The death of Nemesio “El Mencho” Oseguera Cervantes, leader of the Jalisco New Generation Cartel,...

February 24, 2026

1:03 pm

After Reading This, You Will Be Rich in 7 Days

after reading this, you will be rich in 7 days...

February 24, 2026

12:50 pm

Bathroom War’: Why USS Ford Is Facing a Sanitary Crisis at Sea

As the United States stages its largest military buildup in the Middle East since the 2003 Iraq invasion, an unlikely phrase has gone viral: “USS Ford bathroom crisis.” At the center of the story is...

February 24, 2026

12:55 pm

An unusual way of rejuvenation. Better than botox!

an unusual way of rejuvenation. better than botox!...

February 24, 2026

12:50 pm

India Remains Top Buyer as Russian Oil Exports Surge Past Pre-Ukraine-War Levels

Russian oil exports were supposed to be one of the West’s most powerful pressure points after Moscow launched its full-scale invasion of Ukraine in 2022. Yet nearly four years into the war, the numbers tell...

February 24, 2026

12:44 pm

If You Find Moles or Skin Tags on Your Body, Read About This Remedy

if you find moles or skin tags on your body, read about this remedy...

February 24, 2026

12:32 pm

Rob Jetten Becomes Netherlands’ Youngest, First Openly Gay PM

The Netherlands has a new leader — and a political first. Rob Jetten, 38, was sworn in Monday as the country’s youngest-ever prime minister and its first openly gay leader. His rise marks a sharp...

February 24, 2026

12:37 pm

I did this and my knees and joints haven’t hurt for 10 years now.

i did this and my knees and joints haven’t hurt for 10 years now....

February 24, 2026

12:12 pm