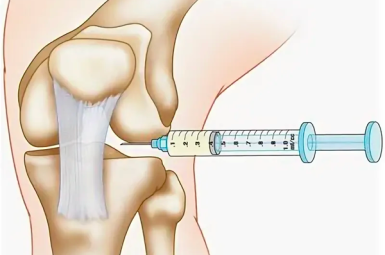

people from us those with knee and hip pain should read this!...

April 7, 2025

8:26 am

an unusual way of rejuvenation. better than botox!...

April 7, 2025

8:22 am

From ‘Black Monday’ to the dot-com bust: The 5 biggest US stock market crashes in history

April 7, 2025

08:49

As U.S. markets show signs of instability in early 2025—driven largely by President Donald Trump’s global tariff policies and economic slowdown concerns—investors are increasingly worried about the possibility of another significant market downturn.

While market fluctuations are common, true stock market crashes represent something far more severe: precipitous declines of 20 percent or more across broad market segments in just days or weeks.

These financial cataclysms, though notoriously difficult to predict, have periodically reshaped the American economic landscape. As current market volatility continues, a look back at history’s most devastating crashes provides valuable context for today’s investors.

Recent Posts

worms come out of you in the morning. try it...

April 7, 2025

8:36 am

carry this with you and luck will find you....

April 7, 2025

8:46 am

doctor: if you have nail fungus, do this immediately...

April 7, 2025

8:26 am

i weighed 332 lbs, and now 109! my diet is very simple trick. 1/2 cup of this (before bed)...

April 7, 2025

8:20 am

While regular market corrections are frequent occurrences, genuine stock market crashes are distinguished by their severity and rapid pace. Generally, analysts classify a crash as a decline of 20 percent or more across major indexes within a condensed timeframe—often just days.

These events typically trigger widespread panic selling, liquidity crises, and in some cases, lasting economic damage. Here’s an examination of the five most consequential market crashes in U.S. history:

The most infamous crash in American financial history began in October 1929, effectively ending the economic prosperity of the Roaring Twenties and catalyzing the Great Depression. After years of speculative excess, the market’s collapse was devastating in both its scale and lasting consequences.

Recent Posts

varicose veins and blood clots will disappear very quickly ! at home!...

April 7, 2025

8:27 am

if you find moles or skin tags on your body, read about this remedy. genius!...

April 7, 2025

8:43 am

your hair will grow by leaps and bounds. you only need 1 product...

April 7, 2025

8:21 am

knee & joint pain will go away if you do this every morning!...

April 7, 2025

8:23 am

Financial historians largely attribute the crash to excessive leverage, with investors borrowing heavily to purchase stocks on margin. When confidence finally broke, the selling cascade proved unstoppable, wiping out countless fortunes and triggering a decade-long economic crisis.

The single most dramatic day in U.S. market history occurred on October 19, 1987, when the Dow Jones Industrial Average plummeted an astonishing 22.6 percent—a loss of 508 points. This unprecedented single-day collapse, known as “Black Monday,” sent shockwaves through global financial markets.

Many analysts blamed newly implemented computerized trading programs that triggered automatic sell orders once certain thresholds were breached, creating a self-reinforcing spiral of selling pressure. Despite its intensity, the market demonstrated remarkable resilience, recovering its losses within two years.

Recent Posts

stars are now ditching botox thanks to this new product......

April 7, 2025

8:46 am

doctor: a teaspoon kills all parasites in your body!...

April 7, 2025

8:33 am

seer teresa: if you carry them in your pocket, you will have a lot of money...

April 7, 2025

8:47 am

doctor: if you have nail fungus, do this immediately...

April 7, 2025

8:38 am

The late 1990s witnessed explosive growth in technology stocks as investors poured money into internet-based companies, many with questionable business models but tremendous hype. The tech-heavy NASDAQ Composite surged from 1,000 points in 1995 to over 5,000 by early 2000.

The bubble began deflating in earnest in 2001. On March 10, the Nasdaq peaked at 5,048.62 points before beginning a devastating decline, eventually falling 76.81% to 1,139.90 by October 4, 2002. Overvalued internet companies with little revenue and no profits bore the brunt of the collapse. The NASDAQ would not regain its 2001 peak for nearly 15 years.

The 2008 crash originated in the housing market, where relaxed lending standards promoted by Fannie Mae beginning in 1999 had dramatically expanded mortgage availability to subprime borrowers. This fueled explosive growth in home sales and consumer debt throughout the early 2000s.

Recent Posts

my weight was 198 lbs, and now it’s 128 lbs! my diet is simple. 1/2 cup of this (before bed)...

April 7, 2025

8:37 am

america is in shock! it helps to get rid of varicose veins. do it at night...

April 7, 2025

8:34 am

if you find moles or skin tags on your body, read about this remedy...

April 7, 2025

8:28 am

hair grows back in 2 weeks! at any stage of baldness...

April 7, 2025

8:34 am

Financial institutions increasingly leveraged cheap debt to boost investment returns, while corporations expanded aggressively through borrowing. Warning signs appeared in March 2007 when investment bank Bear Stearns couldn’t cover losses linked to subprime mortgages.

By September 2008, major stock indexes had shed nearly 20% of their value. The Dow ultimately bottomed on March 6, 2009, having plunged 54% from its peak. Full recovery took four years, with lasting economic damage felt across multiple sectors.

The most recent major crash coincided with the global spread of COVID-19. Markets reacted violently during the week of February 24, 2020, with the Dow Jones and S&P 500 plummeting 11% and 12%, respectively—the largest weekly declines since 2008.

Recent Posts

i did this and my knees and joints haven’t hurt for 10 years now....

April 7, 2025

8:36 am

easy ways to get rid of wrinkles at home! (try now)...

April 7, 2025

8:24 am

this simple trick removes all parasites from your body!...

April 7, 2025

8:41 am

after reading this, you will be rich in 7 days. simple trick...

April 7, 2025

8:22 am

March 12 saw the Dow fall 9.99%, its worst single-day performance since 1987, followed by an even steeper 12.9% drop on March 16. Unlike previous crashes, however, the recovery proved remarkably swift, with markets regaining pre-pandemic levels by May 2020.

This unprecedented rebound was powered by massive government intervention, including Federal Reserve interest rate cuts, $1.5 trillion injected into money markets, and a $2.2 trillion congressional aid package approved in late March.

As current market turbulence continues amid concerns about tariff policies and economic slowdown, investors would be wise to consider these historical precedents.

While the precise timing of market crashes remains virtually impossible to predict, understanding their common triggers—excessive leverage, overvaluation, external shocks, and the psychology of panic—provides valuable perspectives for navigating today’s uncertain investment landscape.

This article From ‘Black Monday’ to the dot-com bust: The 5 biggest US stock market crashes in history appeared first on BreezyScroll.

Read more on BreezyScroll.

Recent Posts

Within hours of the death of Nemesio “El Mencho” Oseguera Cervantes, leader of the Jalisco New Generation Cartel, Mexico was once again confronting a familiar question: how deep did the cartel’s influence run? Now, a...

February 24, 2026

1:09 pm

the fungus will disappear in 1 day! write a specialist's prescription...

February 24, 2026

12:52 pm

Flights disrupted, army on the road, and rising fears of turf wars define Mexico 24 hours after El Mencho’s killing. The death of Nemesio “El Mencho” Oseguera Cervantes, leader of the Jalisco New Generation Cartel,...

February 24, 2026

1:03 pm

i weighed 332 lbs, and now 109! my diet is very simple trick. 1/2 cup of this (before bed)...

February 24, 2026

12:45 pm

As the United States stages its largest military buildup in the Middle East since the 2003 Iraq invasion, an unlikely phrase has gone viral: “USS Ford bathroom crisis.” At the center of the story is...

February 24, 2026

12:55 pm

varicose veins will go away ! the easiest way!...

February 24, 2026

12:32 pm

Russian oil exports were supposed to be one of the West’s most powerful pressure points after Moscow launched its full-scale invasion of Ukraine in 2022. Yet nearly four years into the war, the numbers tell...

February 24, 2026

12:44 pm

if you find moles or skin tags on your body, read about this remedy. genius!...

February 24, 2026

12:31 pm

The Netherlands has a new leader — and a political first. Rob Jetten, 38, was sworn in Monday as the country’s youngest-ever prime minister and its first openly gay leader. His rise marks a sharp...

February 24, 2026

12:37 pm

hair grows 2 cm per day! just do this...

February 24, 2026

12:14 pm

Hours after President Donald Trump ordered the release of government files related to UFOs and extraterrestrial life, a massive online archive of declassified records vanished. Nearly 3.8 million files were removed from The Black Vault,...

February 24, 2026

12:33 pm

people from us those with knee and hip pain should read this!...

February 24, 2026

12:21 pm