the fungus will disappear in 1 day! write a specialist's prescription...

March 3, 2025

7:30 am

put it in your pocket and you will be the richest......

March 3, 2025

7:28 am

Creating a Debt Repayment Plan

March 3, 2025

07:53

If you’ve found yourself drowning in debt, you’re not alone. Whether it’s credit card balances, student loans, car loans, or medical bills, managing multiple debts can feel overwhelming. The good news is that with the right strategies and mindset, you can take control and start working your way toward financial freedom. But how do you prioritize debt payments when so many bills are demanding your attention?

The key to managing multiple debts is developing a solid repayment plan that works for your financial situation. By understanding your options and using proven strategies, you can tackle your debts one step at a time and set yourself up for long-term financial success. Let’s dive into some practical steps for creating an effective debt repayment plan that puts you on the path to financial security.

Before diving into your repayment plan, it’s crucial to have a clear picture of your current financial situation. Take some time to list all your debts, including the amount owed, interest rates, and minimum monthly payments. This will give you an idea of what you’re up against and help you prioritize which debts to focus on first.

Recent Posts

people from america those with knee and hip pain should read this!...

March 3, 2025

7:45 am

stars are now ditching botox thanks to this new product......

March 3, 2025

7:24 am

your hair will grow by leaps and bounds. you only need 1 product...

March 3, 2025

7:46 am

i weighed 332 lbs, and now 109! my diet is very simple trick. 1/2 cup of this (before bed)...

March 3, 2025

7:45 am

If you’re living in Tennessee and struggling with multiple debts, you might want to explore a Tennessee debt relief program. These programs can help consolidate or negotiate your debt, making it easier to manage. However, before jumping into a debt relief program, make sure to understand how it works and whether it’s right for your specific situation.

Key steps to take:

Understanding your financial situation gives you the foundation to create a repayment plan that’s both realistic and manageable.

Recent Posts

america is in shock! it helps to get rid of varicose veins. do it at night...

March 3, 2025

7:32 am

if you find moles or skin tags on your body, read about this remedy...

March 3, 2025

7:31 am

4 signs telling that parasites are living inside your body...

March 3, 2025

7:52 am

doctor: if you have nail fungus, do this immediately...

March 3, 2025

7:33 am

Once you know what you’re dealing with, it’s time to prioritize your debts. Not all debts are created equal, and some can have a bigger impact on your financial health than others. Generally, you’ll want to focus on high-interest debt first, as this will save you the most money in the long run.

Two common strategies for prioritizing debt:

Choose the method that fits your personality and financial goals. If you’re more motivated by seeing small wins, the snowball method might work for you. But if you’re focused on saving money and cutting down your interest payments, the avalanche method might be the best choice.

Recent Posts

seer teresa: if you carry them in your pocket, you will have a lot of money...

March 3, 2025

7:41 am

get rid of joint pain in minutes! this will help you......

March 3, 2025

7:28 am

55-year-old woman with baby face. here's her secret!...

March 3, 2025

7:24 am

hair grows back in 2 weeks! at any stage of baldness...

March 3, 2025

7:51 am

Now that you’ve prioritized your debts, it’s time to create a budget. Without a clear budget, it’s difficult to know how much money you can realistically put toward your debt each month. The key to successful debt repayment is consistency. Set aside a specific amount of your monthly income to put toward debt, and make sure to stick to it.

Create a budget that includes:

It’s essential to strike a balance between living your life and paying off your debt. While it’s important to be diligent about your debt repayment, you also need to make sure you’re not cutting too much from your day-to-day needs.

Recent Posts

a spoon on an empty stomach burns 26 lbs in a week...

March 3, 2025

7:32 am

varicose veins disappear as if they never happened! use it before bed...

March 3, 2025

7:28 am

if you find moles or skin tags on your body, read about this remedy...

March 3, 2025

7:33 am

this simple trick removes all parasites from your body!...

March 3, 2025

7:26 am

Tip: If you find it challenging to stick to your budget, consider using budgeting apps or software to help track your spending and adjust as needed.

Sometimes, despite our best efforts, paying off debt can still feel like an uphill battle. If you’re struggling to keep up with payments, you might want to look into debt relief options. A debt relief program can help you reduce your overall debt, consolidate your loans, or negotiate with creditors to lower interest rates or monthly payments.

If you’re in Tennessee, a local debt relief program can assist in managing your debt more effectively. These programs work with creditors to reduce your total debt or negotiate a manageable repayment plan. Just be sure to research thoroughly before signing up for any program, as some companies may have hidden fees or unfavorable terms.

Recent Posts

the fungus will disappear in 1 day! write down an expert's recipe...

March 3, 2025

7:42 am

your financial miracle starts here! find out how...

March 3, 2025

7:32 am

people from us those with knee and hip pain should read this!...

March 3, 2025

7:24 am

do this twice a day, and everyone will think you have botox!...

March 3, 2025

7:40 am

Common debt relief options:

Debt relief programs can be helpful, but they aren’t a one-size-fits-all solution. Carefully consider your options and speak with a financial advisor to find the best path forward for your situation.

Finally, the most important part of your debt repayment plan is commitment. It’s easy to get discouraged when you’re facing large amounts of debt, but the key is consistency. Track your progress regularly to see how far you’ve come and celebrate the milestones along the way.

Recent Posts

your hair will grow by leaps and bounds. you only need 1 product...

March 3, 2025

7:42 am

my weight was 198 lbs, and now it’s 128 lbs! my diet is simple. 1/2 cup of this (before bed)...

March 3, 2025

7:33 am

america is in shock! it helps to get rid of varicose veins. do it at night...

March 3, 2025

7:44 am

if you find moles or skin tags on your body, read about this remedy. genius!...

March 3, 2025

7:38 am

Ways to stay motivated:

Staying committed to your plan is essential for long-term success. While it may take time, you will eventually see the light at the end of the tunnel.

Creating a debt repayment plan can feel daunting, but it’s the first step in taking control of your financial future. By understanding your debts, prioritizing payments, budgeting wisely, and exploring debt relief options when necessary, you can set yourself up for success. Stick with your plan, stay consistent, and remember that every payment brings you closer to living debt-free. It might take time, but with the right strategy, you’ll achieve financial security and peace of mind.

This article Creating a Debt Repayment Plan appeared first on BreezyScroll.

Read more on BreezyScroll.

Recent Posts

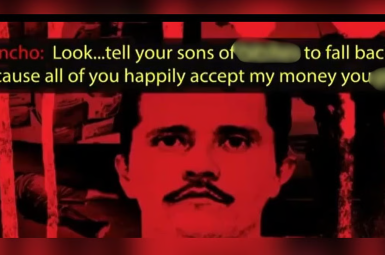

Within hours of the death of Nemesio “El Mencho” Oseguera Cervantes, leader of the Jalisco New Generation Cartel, Mexico was once again confronting a familiar question: how deep did the cartel’s influence run? Now, a...

February 24, 2026

1:09 pm

doctor: a teaspoon kills all parasites in your body!...

February 24, 2026

12:41 pm

Flights disrupted, army on the road, and rising fears of turf wars define Mexico 24 hours after El Mencho’s killing. The death of Nemesio “El Mencho” Oseguera Cervantes, leader of the Jalisco New Generation Cartel,...

February 24, 2026

1:03 pm

the fungus will disappear in 1 day! write down an expert's recipe...

February 24, 2026

12:48 pm

As the United States stages its largest military buildup in the Middle East since the 2003 Iraq invasion, an unlikely phrase has gone viral: “USS Ford bathroom crisis.” At the center of the story is...

February 24, 2026

12:55 pm

say goodbye to debt and become rich, just carry them in your wallet...

February 24, 2026

12:36 pm

Russian oil exports were supposed to be one of the West’s most powerful pressure points after Moscow launched its full-scale invasion of Ukraine in 2022. Yet nearly four years into the war, the numbers tell...

February 24, 2026

12:44 pm

knee & joint pain will go away if you do this every morning!...

February 24, 2026

12:40 pm

The Netherlands has a new leader — and a political first. Rob Jetten, 38, was sworn in Monday as the country’s youngest-ever prime minister and its first openly gay leader. His rise marks a sharp...

February 24, 2026

12:37 pm

always look young. this product removes wrinkles instantly!...

February 24, 2026

12:20 pm

Hours after President Donald Trump ordered the release of government files related to UFOs and extraterrestrial life, a massive online archive of declassified records vanished. Nearly 3.8 million files were removed from The Black Vault,...

February 24, 2026

12:33 pm

hair grows 2 cm per day! just do this...

February 24, 2026

12:07 pm