this simple trick removes all parasites from your body!...

January 2, 2025

12:34 pm

read this immediately if you have moles or skin tags, it's genius...

January 2, 2025

12:55 pm

Boosting Your Credit Profile Holistically

January 2, 2025

13:00

When it comes to improving your credit score, many people focus on just one or two aspects, such as paying off debt or disputing errors on their credit reports. But to truly boost your credit profile sustainably, you need to take a more holistic approach. This means considering all of the factors that make up your credit score, including your payment history, amounts owed, length of credit history, credit mix, and new credit. By understanding how these elements work together, you can make smarter decisions that not only improve your score but also set you up for debt relief and long-term financial success.

Your credit score is a reflection of how well you manage debt and credit. It ranges from 300 to 850, with higher scores indicating better creditworthiness. It’s made up of several key factors, and understanding how they work will help you improve your score over time.

The five main components of your credit score are:

Recent Posts

after reading this, you will be rich in 7 days. simple trick...

January 2, 2025

12:44 pm

doctor: if you have nail fungus, do this immediately...

January 2, 2025

12:45 pm

hair will grow back! no matter how severe the baldness...

January 2, 2025

12:44 pm

varicose veins will go away ! the easiest way!...

January 2, 2025

12:33 pm

Now that you have an idea of what affects your credit score, let’s take a deeper dive into the holistic steps you can take to boost your profile.

Start with the basics: Pay your bills on time

The first and most important step in improving your credit profile is to make sure you’re paying all your bills on time. Late payments have a serious negative impact on your credit score, and missed payments can stay on your credit report for up to seven years.

Recent Posts

my weight was 198 lbs, and now it’s 128 lbs! my diet is simple. 1/2 cup of this (before bed)...

January 2, 2025

12:43 pm

always look young. this product removes wrinkles instantly!...

January 2, 2025

12:50 pm

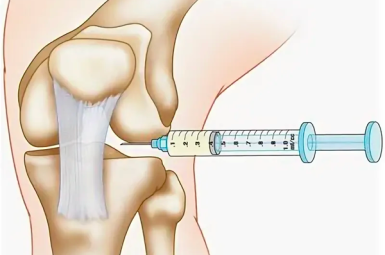

people from america those with knee and hip pain should read this!...

January 2, 2025

12:47 pm

this simple trick removes all parasites from your body!...

January 2, 2025

12:35 pm

This includes credit cards, loans, utility bills, and any other obligations that show up on your credit report.

If you’ve missed payments in the past, don’t get discouraged. Start paying your bills on time from this point forward, and the effects of past late payments will gradually lessen over time. You can also set up reminders or automate your payments to help ensure you never miss a due date.

In cases where your debt feels overwhelming, seeking professional help might be the right choice. Some people explore debt relief options when they find it hard to make consistent payments. These options can sometimes help lower monthly payments or consolidate debt, making it easier to stay on track.

Recent Posts

if you find moles or skin tags on your body, read about this remedy...

January 2, 2025

12:32 pm

carry this with you and luck will find you....

January 2, 2025

12:48 pm

doctor: if you have nail fungus, do this immediately...

January 2, 2025

12:36 pm

your hair will grow by leaps and bounds. you only need 1 product...

January 2, 2025

12:30 pm

Reduce your debt: Lower your credit utilization

The second biggest factor that influences your credit score is the amount of debt you owe. More specifically, credit utilization—the ratio of your credit card balances to your credit limits—plays a significant role. It’s generally recommended to keep your credit utilization below 30%. For example, if you have a $1,000 credit limit, try to keep your balance under $300.

If you’re using a high percentage of your available credit, it can signal to lenders that you may be overextended, which can lower your score. To improve your credit, focus on paying down high-interest debt, especially credit card balances. As you pay down your balances, your credit utilization will decrease, and your score will improve.

Recent Posts

varicose veins will go away ! the easiest way!...

January 2, 2025

12:39 pm

my weight was 198 lbs, and now it’s 128 lbs! my diet is simple. 1/2 cup of this (before bed)...

January 2, 2025

12:57 pm

a young face overnight. you have to try this!...

January 2, 2025

12:51 pm

forget about joint pain forever – the solution is here!...

January 2, 2025

12:41 pm

Even if you can’t pay off all your credit card debt immediately, consider making larger payments to bring down your balances faster. Additionally, if you can, request a credit limit increase. This can improve your credit utilization ratio, but be careful not to increase your spending as your limit grows.

One thing that many people overlook is the length of their credit history. While you can’t exactly speed up the age of your credit accounts, you can make sure to keep your old accounts open rather than closing them. The longer your credit history, the better it is for your credit score. So, if you have an old credit card account, consider keeping it open (even if you don’t use it) to improve your credit score.

This factor isn’t something that can be fixed overnight, so don’t worry if you’re still relatively new to credit. As long as you consistently manage your credit wisely, the length of your credit history will improve with time.

Recent Posts

this simple trick removes all parasites from your body!...

January 2, 2025

12:58 pm

if you find moles or skin tags on your body, read about this remedy...

January 2, 2025

12:31 pm

seer teresa: if you carry them in your pocket, you will have a lot of money...

January 2, 2025

12:48 pm

doctor: Іf you have nail fungus, do this immediately...

January 2, 2025

12:52 pm

While it only accounts for 10% of your score, the mix of credit accounts you have is an important factor in boosting your credit profile. Lenders like to see that you can handle different types of credit, such as credit cards, mortgages, auto loans, and personal loans.

If you only have one type of credit (like just credit cards), your credit score may not be as strong as someone with a variety of credit types. However, it’s important not to open new credit accounts just for the sake of increasing your credit mix. Opening too many accounts at once can hurt your score by increasing the number of inquiries into your credit. So, while a mix of credit can help, be strategic about when and how you apply for new credit.

Each time you apply for a new credit card, mortgage, or loan, a hard inquiry is made on your credit report. Too many inquiries can negatively affect your credit score, especially if you open several new accounts in a short period. While having some credit activity is normal, you should avoid unnecessary credit applications, especially if you’re trying to improve your score.

Recent Posts

it couldn't be easier: stop hair loss today!...

January 2, 2025

12:31 pm

varicose veins will disappear in the morning! read!...

January 2, 2025

12:56 pm

lose 40 lbs by consuming before bed for a week...

January 2, 2025

12:36 pm

stars are now ditching botox thanks to this new product......

January 2, 2025

12:53 pm

If you need to apply for credit, try to space out your applications over time. When you’re shopping around for things like a mortgage or car loan, be sure to do it within a short window (usually 30 days). Multiple inquiries within this time frame tend to count as just one, which minimizes the damage to your credit score.

A holistic approach to credit health

Improving your credit profile requires more than just focusing on one or two areas. By taking a holistic approach and considering all the factors that make up your score, you can make smarter financial decisions that will improve your credit profile in the long run.

Remember to pay your bills on time, keep your credit utilization low, and make strategic decisions about your credit accounts. While it takes time, consistency is key to improving your credit score and maintaining it at a healthy level. With a thoughtful, balanced approach, you’ll not only boost your credit score but also build a stronger financial foundation for your future.

Recent Posts

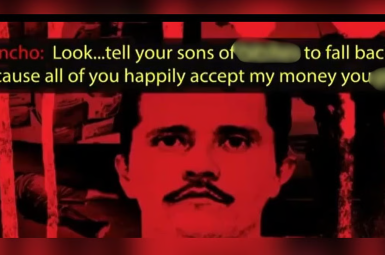

Within hours of the death of Nemesio “El Mencho” Oseguera Cervantes, leader of the Jalisco New Generation Cartel, Mexico was once again confronting a familiar question: how deep did the cartel’s influence run? Now, a...

February 24, 2026

1:09 pm

people from america those with knee and hip pain should read this!...

February 24, 2026

12:55 pm

Flights disrupted, army on the road, and rising fears of turf wars define Mexico 24 hours after El Mencho’s killing. The death of Nemesio “El Mencho” Oseguera Cervantes, leader of the Jalisco New Generation Cartel,...

February 24, 2026

1:03 pm

this simple trick removes all parasites from your body!...

February 24, 2026

1:02 pm

As the United States stages its largest military buildup in the Middle East since the 2003 Iraq invasion, an unlikely phrase has gone viral: “USS Ford bathroom crisis.” At the center of the story is...

February 24, 2026

12:55 pm

if you find moles or skin tags on your body, read about this remedy. genius!...

February 24, 2026

12:51 pm

Russian oil exports were supposed to be one of the West’s most powerful pressure points after Moscow launched its full-scale invasion of Ukraine in 2022. Yet nearly four years into the war, the numbers tell...

February 24, 2026

12:44 pm

your financial miracle starts here! find out how...

February 24, 2026

12:15 pm

The Netherlands has a new leader — and a political first. Rob Jetten, 38, was sworn in Monday as the country’s youngest-ever prime minister and its first openly gay leader. His rise marks a sharp...

February 24, 2026

12:37 pm

do this every night and the fungus will disappear in 5 days...

February 24, 2026

12:14 pm

Hours after President Donald Trump ordered the release of government files related to UFOs and extraterrestrial life, a massive online archive of declassified records vanished. Nearly 3.8 million files were removed from The Black Vault,...

February 24, 2026

12:33 pm

hair grows back in 2 weeks! at any stage of baldness...

February 24, 2026

12:22 pm