if you find moles or skin tags on your body, read about this remedy. genius!...

November 24, 2024

12:37 pm

salvation from baldness has been found! (do this before bed)...

November 24, 2024

12:45 pm

Cognitive Biases And Money

November 24, 2024

13:00

When it comes to managing money, our decisions often feel rational and well thought out. However, the truth is that many of our financial choices are influenced by cognitive biases—mental shortcuts or tendencies that can lead us astray. These biases can significantly affect how we approach saving, investing, and even dealing with debt. Understanding these cognitive biases can help us make better financial decisions and potentially increase our overall wealth.

For instance, when dealing with financial troubles, many people might consider a debt settlement plan. However, biases can influence whether they pursue that option or get stuck in a cycle of debt. Let’s explore some common cognitive biases related to money and how they may be impacting your financial journey.

One cognitive bias that can affect financial decisions is the anchoring effect. This bias occurs when individuals rely too heavily on the first piece of information they encounter when making decisions. For example, if you first hear that a particular stock is priced at $100, you might anchor your perception of that stock’s value to that initial price, regardless of its actual market fluctuations.

Recent Posts

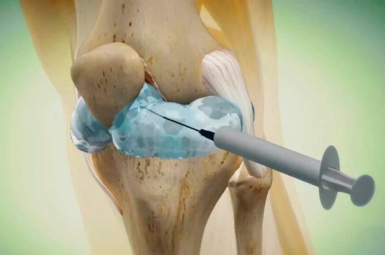

knee & joint pain will go away if you do this every morning!...

November 24, 2024

12:57 pm

stars are now ditching botox thanks to this new product....

November 24, 2024

12:51 pm

this simple trick removes all parasites from your body!...

November 24, 2024

12:56 pm

a spoon on an empty stomach burns 26 lbs in a week...

November 24, 2024

12:37 pm

This can be problematic in investing. If the stock price drops to $80, you might hold on to it longer than you should because you’re anchored to the $100 div. Instead of making decisions based on the stock’s current performance and market conditions, you’re stuck in the past.

Loss aversion is another cognitive bias that can heavily influence financial behaviors. This concept refers to the idea that people are more motivated by the fear of losing money than by the potential for gaining money. Studies suggest that the pain of losing $100 feels more intense than the pleasure of gaining $100.

As a result, many individuals become overly cautious with their investments. They might avoid high-risk opportunities that could lead to significant gains simply because they fear the possibility of losing money. This bias can prevent people from taking calculated risks that could enhance their financial growth.

Recent Posts

doctor: if you have nail fungus, do this immediately...

November 24, 2024

12:32 pm

america is in shock! it helps to get rid of varicose veins. do it at night...

November 24, 2024

12:37 pm

tired of debt? become a money magnet and leave poverty behind!...

November 24, 2024

12:31 pm

read this immediately if you have moles or skin tags, it's genius...

November 24, 2024

12:47 pm

Confirmation bias is the tendency to search for, interpret, and remember information in a way that confirms your pre-existing beliefs. In the context of money, this bias can lead to poor financial decisions, as people may ignore evidence that contradicts their views.

For instance, if you believe that a specific investment is a sure thing, you may only seek out news articles or data that support this belief while ignoring warnings about market volatility. This can lead to overconfidence in your investments and result in significant losses when the market doesn’t behave as expected.

The sunk cost fallacy is a cognitive bias where individuals continue investing time, money, or effort into a project or decision based on the amount they have already invested, rather than on future returns. This is especially common in investing and financial decision-making.

Recent Posts

hair grows back in 2 weeks! at any stage of baldness...

November 24, 2024

12:31 pm

healthy joints in 7 days! no doctors or surgery!...

November 24, 2024

12:51 pm

easy ways to get rid of wrinkles at home! (try now)...

November 24, 2024

12:38 pm

4 signs telling that parasites are living inside your body...

November 24, 2024

12:38 pm

For example, if you’ve invested a significant amount of money in a business venture that isn’t performing well, you might be reluctant to pull out because you don’t want to “waste” the money you’ve already spent. Instead of evaluating the current potential for that investment, you allow past expenditures to cloud your judgment.

This bias can lead to poor financial decisions and increased losses, as you may end up pouring more resources into a failing investment instead of reallocating those funds to more promising opportunities.

Overconfidence bias is when individuals have an inflated belief in their abilities or knowledge, particularly regarding investing and financial decisions. Many people believe they can predict market movements or successfully pick stocks without adequate research.

Recent Posts

my weight was 198 lbs, and now it’s 128 lbs! my diet is simple. 1/2 cup of this (before bed)...

November 24, 2024

12:33 pm

the fungus will disappear in 1 day! write a specialist's prescription...

November 24, 2024

12:35 pm

varicose veins will disappear in the morning! read!...

November 24, 2024

12:43 pm

your financial miracle starts here! find out how...

November 24, 2024

12:48 pm

This bias can lead to risky behaviors, such as making large investments based on hunches or trends without doing proper due diligence. Overconfidence can result in substantial losses, especially in volatile markets where emotions can run high. It’s essential to remain grounded and base financial decisions on data and thorough analysis rather than gut feelings.

Herd mentality, or herd behavior, is the tendency for individuals to follow the actions of a larger group, often without critically analyzing the situation. In finance, this can manifest when investors rush to buy or sell stocks based on market trends or the actions of others rather than on their own analysis.

For instance, during a market upswing, you may feel pressured to invest in a hot stock simply because everyone else is doing it. Conversely, during a market downturn, you might panic and sell off your investments because you see others doing the same. Herd mentality can lead to buying high and selling low, which is the opposite of a successful investment strategy.

Recent Posts

if you find moles or skin tags on your body, read about this remedy...

November 24, 2024

12:51 pm

hair grows back in 2 weeks! at any stage of baldness...

November 24, 2024

12:37 pm

knee & joint pain will go away if you do this every morning!...

November 24, 2024

12:53 pm

a young face overnight. you have to try this!...

November 24, 2024

12:30 pm

Impulsivity is another cognitive bias that can impact financial decision-making. This bias leads individuals to make hasty decisions without thoroughly considering the consequences. In terms of money, impulsive purchases can derail budgets and lead to unnecessary debt.

For example, you might come across a great sale and buy an expensive gadget you don’t really need. This impulse can be driven by emotions, advertising, or social pressure, resulting in spending that doesn’t align with your financial goals. Developing strategies to slow down your decision-making process can help mitigate the effects of this bias.

The first step in overcoming cognitive biases is to recognize them. Take a moment to reflect on your financial decisions. Are there patterns that suggest a specific bias is influencing your choices? Consider keeping a journal of your financial decisions, including the thought process behind them. This can help you identify biases and patterns over time.

Recent Posts

doctor: a teaspoon kills all parasites in your body!...

November 24, 2024

12:45 pm

lose 40 lbs by consuming before bed for a week...

November 24, 2024

12:48 pm

the fungus will disappear in 1 day! write a specialist's prescription...

November 24, 2024

12:51 pm

varicose veins and blood clots will disappear very quickly ! at home!...

November 24, 2024

12:33 pm

Educating yourself about personal finance and investment strategies can also mitigate the effects of cognitive biases. The more informed you are, the less likely you are to fall prey to biases that can derail your financial goals.

Additionally, consider seeking advice from a financial advisor or mentor who can provide an objective perspective. Having someone to discuss your financial strategies with can help you avoid decisions driven by cognitive biases.

Cognitive biases can have a significant impact on your financial decisions and overall wealth accumulation. By understanding these biases—such as loss aversion, confirmation bias, and impulsivity—you can make more informed choices about your money and investments.

It’s essential to recognize that everyone has biases; the key is being aware of them and working to counteract their effects. By cultivating healthy financial habits and making decisions based on research and analysis rather than emotions, you can chart a more successful path to financial well-being. Remember, the journey to financial freedom is as much about mindset as it is about money!

Recent Posts

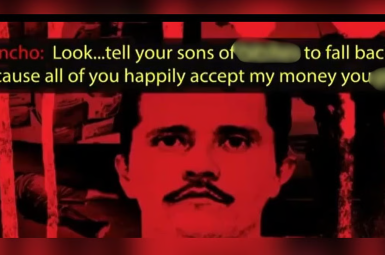

Within hours of the death of Nemesio “El Mencho” Oseguera Cervantes, leader of the Jalisco New Generation Cartel, Mexico was once again confronting a familiar question: how deep did the cartel’s influence run? Now, a...

February 24, 2026

1:09 pm

say goodbye to debt and become rich, just carry them in your wallet...

February 24, 2026

12:53 pm

Flights disrupted, army on the road, and rising fears of turf wars define Mexico 24 hours after El Mencho’s killing. The death of Nemesio “El Mencho” Oseguera Cervantes, leader of the Jalisco New Generation Cartel,...

February 24, 2026

1:03 pm

if you find moles or skin tags on your body, read about this remedy...

February 24, 2026

12:35 pm

As the United States stages its largest military buildup in the Middle East since the 2003 Iraq invasion, an unlikely phrase has gone viral: “USS Ford bathroom crisis.” At the center of the story is...

February 24, 2026

12:55 pm

salvation from baldness has been found! (do this before bed)...

February 24, 2026

12:43 pm

Russian oil exports were supposed to be one of the West’s most powerful pressure points after Moscow launched its full-scale invasion of Ukraine in 2022. Yet nearly four years into the war, the numbers tell...

February 24, 2026

12:44 pm

the secret way to get rid of knee and joint pain!...

February 24, 2026

12:23 pm

The Netherlands has a new leader — and a political first. Rob Jetten, 38, was sworn in Monday as the country’s youngest-ever prime minister and its first openly gay leader. His rise marks a sharp...

February 24, 2026

12:37 pm

an unusual way of rejuvenation. better than botox!...

February 24, 2026

12:30 pm

Hours after President Donald Trump ordered the release of government files related to UFOs and extraterrestrial life, a massive online archive of declassified records vanished. Nearly 3.8 million files were removed from The Black Vault,...

February 24, 2026

12:33 pm

worms come out of you in the morning. try it...

February 24, 2026

12:12 pm