this simple trick removes all parasites from your body!...

September 17, 2025

5:23 am

after reading this, you will be rich in 7 days. simple trick...

September 17, 2025

5:35 am

Student Loan Borrowers Face ‘Enormous Tax Liability’ as Trump Administration Delays Forgiveness

September 17, 2025

05:36

Millions of student loan borrowers entitled to debt forgiveness may soon face an unexpected and “enormous tax liability” due to delays under the Trump administration, according to a new filing by the American Federation of Teachers (AFT).

At issue is the expiration of a temporary tax exemption on forgiven student debt. Under the American Rescue Plan Act of 2021, any student loan forgiveness was tax-free at the federal level—but only until December 31, 2025. Unless Congress extends the provision, borrowers who receive loan cancellation in 2026 or beyond will owe federal income tax on the amount forgiven.

With over 1.3 million borrowers waiting to access income-driven repayment (IDR) plans and more than 72,000 awaiting Public Service Loan Forgiveness (PSLF) determinations, delays at the Department of Education mean many risk missing the window.

Recent Posts

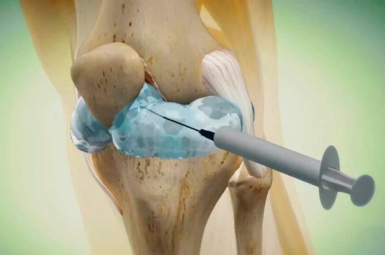

people from us those with knee and hip pain should read this!...

September 17, 2025

5:24 am

read this immediately if you have moles or skin tags, it's genius...

September 17, 2025

5:27 am

salvation from baldness has been found! (do this before bed)...

September 17, 2025

5:24 am

a young face overnight. you have to try this!...

September 17, 2025

5:19 am

IDR plans are designed to help struggling borrowers by tying their monthly payments to their income. After 20–25 years of payments, any remaining balance is forgiven.

Key features:

PSLF offers a faster path: loan forgiveness after 10 years of payments for qualifying public service workers. Importantly, PSLF forgiveness is not taxable at the federal level, though states may still levy taxes.

Recent Posts

do this every night and the fungus will disappear in 5 days...

September 17, 2025

5:30 am

america is in shock! it helps to get rid of varicose veins. do it at night...

September 17, 2025

5:08 am

a spoon on an empty stomach burns 26 lbs in a week...

September 17, 2025

5:06 am

doctor: a teaspoon kills all parasites in your body!...

September 17, 2025

5:10 am

Experts warn that the tax bills tied to forgiven debt could be devastating:

And this is just the federal liability—some states may also tax forgiven debt if they align with federal tax law after the exemption expires.

The AFT argues the Trump administration is unlawfully blocking or slow-walking access to IDR and other forgiveness programs, effectively setting up borrowers for higher costs. The union is seeking class action status in its lawsuit against the Department of Education.

Recent Posts

seer teresa: if you carry them in your pocket, you will have a lot of money...

September 17, 2025

5:34 am

knee pain gone! i didn't believe it, but i tried it!...

September 17, 2025

5:22 am

if you find moles or skin tags on your body, read about this remedy. genius!...

September 17, 2025

5:24 am

hair grows back in 2 weeks! at any stage of baldness...

September 17, 2025

5:21 am

Lawmakers including Sen. Bernie Sanders (I-Vt.) have also raised alarms, warning Education Secretary Linda McMahon that borrowers may be unfairly penalized if debt forgiveness isn’t processed before the tax-free window closes.

Experts recommend that borrowers take proactive steps while the legal and political battles play out:

The combination of bureaucratic delays and a looming tax law change means student loan borrowers are facing more uncertainty than ever. Unless Congress acts to extend tax-free forgiveness—or the Department of Education accelerates approvals—millions may find that their long-awaited debt relief comes with a hefty IRS bill.

Recent Posts

Bill Gates has acknowledged having two affairs with Russian women during his marriage to Melinda French Gates and expressed regret over his past association with Jeffrey Epstein. Speaking at a company town hall on February...

February 26, 2026

4:57 am

easy ways to get rid of wrinkles at home! (try now)...

February 26, 2026

4:28 am

China and Mexico’s drug trade: A century-long pipeline The China and Mexico drug trade did not begin with fentanyl. It began with opium pipes in the early 1900s and has evolved into a transnational supply...

February 26, 2026

4:48 am

do this every night and the fungus will disappear in 5 days...

February 26, 2026

4:40 am

An optical illusion of a male body part is circulating online, and it’s turning timelines into staring contests. At first glance, the image appears to show a thin, hairy neck with a black leather necklace...

February 26, 2026

4:42 am

varicose veins will disappear in the morning! read!...

February 26, 2026

4:32 am

Formula 1 is rewriting a small but powerful piece of its own track map. At the upcoming Australian Grand Prix, Turn 6 will be named in honor of Laura Mueller and Hannah Schmitz, marking the...

February 26, 2026

4:32 am

i weighed 332 lbs, and now 109! my diet is very simple trick. 1/2 cup of this (before bed)...

February 26, 2026

4:29 am

As the war between Ukraine and Russia enters its fourth year, Volodymyr Zelenskyy has opened a door few outsiders had seen before. In a nearly 19-minute video posted on X, the Ukrainian president revealed the...

February 26, 2026

4:26 am

this simple trick removes all parasites from your body!...

February 26, 2026

4:02 am

President Donald Trump used his 2026 State of the Union address to spotlight a rarely seen corner of America’s military machine. In a prime-time moment at SOTU 2026, he awarded the Medal of Honor to...

February 26, 2026

4:21 am

carry this with you and luck will find you....

February 26, 2026

4:00 am